From Bloomber Businessweek

It’s scary out there. The rout in the stock market that began around Jan. 1 took a turn for the worse early this month. By Feb. 10 the Standard & Poor’s 500-stock index was down 9 percent for the year. That’s its worst start since the recession year of 2008. Falling oil prices were blamed: A meeting between Saudis and Venezuelans aimed at curbing production had ended inconclusively. West Texas Intermediate fell again below $28 a barrel—more than 70 percent off its 2014 high. Trigger-happy investors have gotten accustomed to selling stocks whenever oil dips. With oil in serious oversupply, it’s hard to sustain any kind of recovery on Wall Street. “The toughest problem for people to deal with is oil getting linked with the market,” says Tobias Levkovich, Citigroup’s chief U.S. equity strategist.

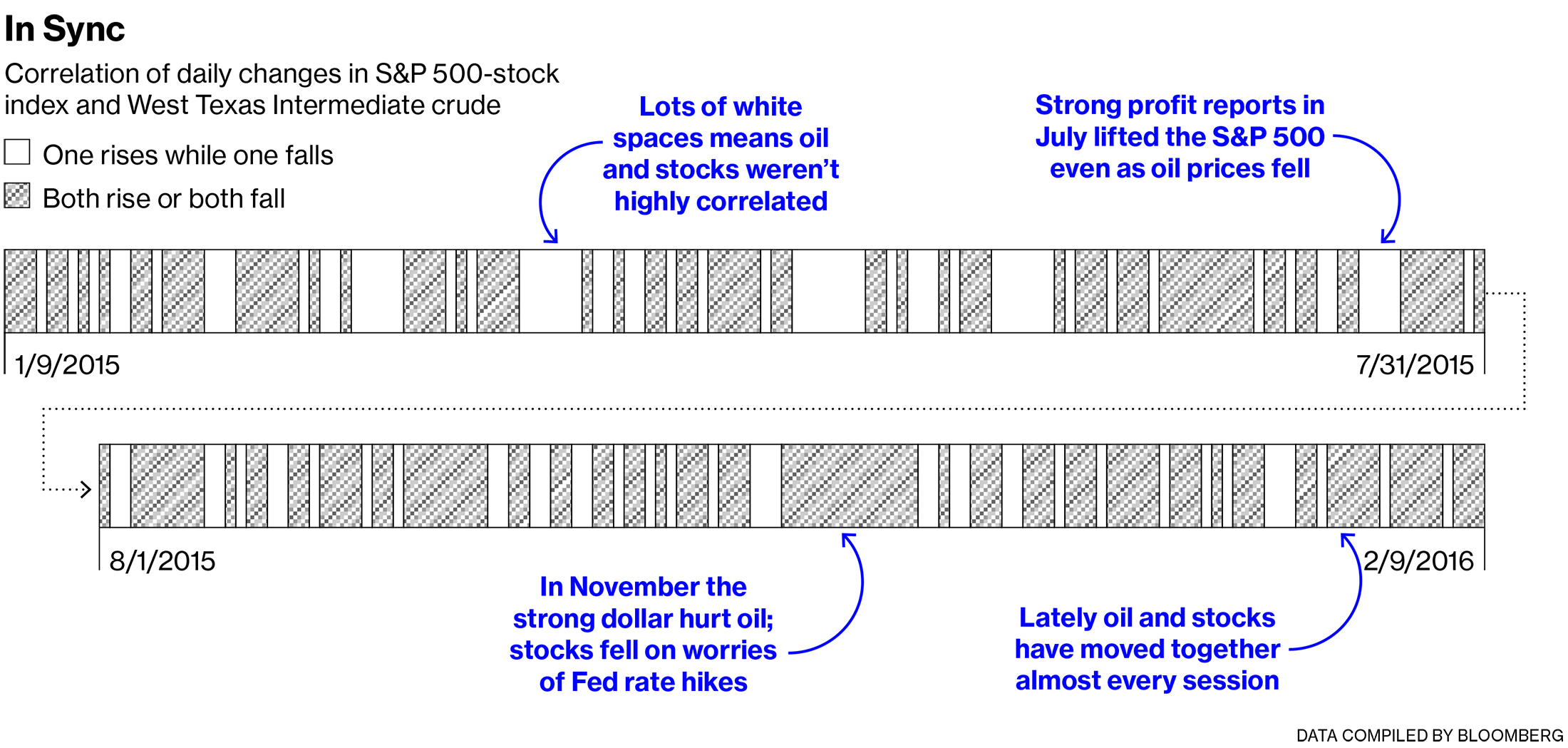

Just in time for Valentine’s Day, it appears that oil and stocks have developed an unhealthy, codependent relationship. They’re way too deep into each other. Where one market goes, the other follows. If they were people, a counselor would be urging a trial separation. “This is highly unusual,” Torsten Slok, chief international economist at Deutsche Bank, wrote to clients in late January. “Call it the oil correlation conundrum.”

Or oilmageddon, as Citigroup economists have named it. Before you join the Cassandras, though, here are a few things to consider: First, cheap oil isn’t the boogeyman you’d think it is from reading the headlines. Upward spikes in energy prices cause recessions; dips don’t. The national average price of gasoline is down $1.01 from last summer. The money people save is fueling purchases of things like takeout food. “If you’re driving to work every day and you save $10 at the gas pump, you stop at Starbucks or whatever and spend part of that savings,” says Michael Montgomery, an economist with IHS Global Insight.

True, Americans are banking most of their savings right now. But that’s good in the long run, too. Americans’ debt payments, rent, leases, and other obligations are close to their lowest share of income since the Federal Reserve began tracking the ratio in 1980. Since consumers account for the lion’s share of the U.S. economy, anything that improves their financial situation makes it more resilient.

Second, the notion that cheap oil signals recession—the idea being that the price decline indicates declining global demand—is contradicted by the evidence. Far from falling, world oil consumption rose by 3.1 million barrels a day in the two years through the third quarter of 2015, according to the International Energy Agency. It’s just that the supply grew even faster, by 5 million barrels a day. “With the market already awash in oil, it is very hard to see how oil prices can rise significantly in the short term,” the agency said on Feb. 8. Prices might even go lower temporarily before rebounding. “I wouldn’t be surprised if this market goes into the teens,” Jeff Currie, Goldman Sachs’s head of commodities research, told Bloomberg TV on Feb. 8.

Third—and now we’re laying out the other side of the argument—all this doesn’t mean Wall Street is entirely irrational to tremble when crude tumbles. The market turmoil is shaking up companies as far afield as St. Louis-based Emerson Electric, headed since 2000 by Chief Executive Officer David Farr. Emerson makes products ranging from oil-production instruments to closet organizers. “The last 30 days have been what I would call the most unusual in my time at Emerson. I’ve never seen a marketplace go so volatile,” Farr told analysts on Feb. 2.

ExxonMobil is facing a potential credit downgrade for the first time since the Great Depression. ConocoPhillips is cutting its dividend for the first time in a quarter-century. Energy stocks account for 6.6 percent of the S&P 500’s market value. While that’s only half their share of five years ago, it’s still big enough for them to drag down the overall index on bad days.

In 2014 the energy industry accounted for nearly one-third of S&P 500 companies’ capital expenditures, according to data compiled by Bloomberg. At least $1 trillion in spending is getting canceled, says Steven Kopits, president of Princeton Energy Advisors. When energy companies cut back, pipe makers, truckers, railroads, and businesses in other industries suffer.

Then there’s the financial sector. Oil drillers borrowed heavily to expand production, and many can’t make money at today’s superlow prices. As much as 15 percent of the face value of high-yield bonds owed by U.S. oil producers and service companies could go into default this year, according to BCA Research. “The major risk banks have isn’t to their normal retail-oriented stuff, it’s to the oil space,” says Andrew Brenner, head of international fixed income at National Alliance Capital Markets in New York. Markets were rattled on Feb. 8 after the Debtwire news service reported that Chesapeake Energy, the No. 2 U.S. natural gas producer, had hired a law firm to restructure a $9.8 billion debt load. The company issued a statement saying it has no plans to pursue bankruptcy.

Trouble could radiate outward if banks, their balance sheets weakened by defaults in the oil industry, cut back lending to other enterprises. Says Nicholas Sargen, chief economist at Fort Washington Investment Advisors: “There are some people beginning to worry that this thing could spread like the subprime crisis. People said then that it was too small to matter, and then you find out there are linkages you didn’t know about.”

How long will oil and stocks continue their doomed embrace? No one knows for sure, but there are signs that emotion has gotten the better of investors. Once things calm down, the underlying strengths of the U.S. economy could start to become clearer. At that point, stocks could start to rebound even if—or because!—the global glut of crude keeps oil prices low.

History is a useful guide. So far this year, the S&P 500 is moving in closer tandem with West Texas Intermediate, the benchmark U.S. crude oil, than in any year since 2000 except for 2010. The reasons for the high correlation in 2010 were similar: abundant oil supplies and fears about global growth. Interestingly, around the second week of February 2010, the mood turned. The correlation continued, but with oil and stocks both rising instead of falling.

Stocks and oil tend to move up together in times of optimism about demand and fall together in times of pessimism about demand, according to a 2008 analysis by Andrea Pescatori, a Federal Reserve Bank of Cleveland economist who’s now at the International Monetary Fund. If that’s so, the current high correlation is as much a barometer of sentiment about the outlook for global growth as it is an indication of what’s happening in the real world. “Right now, anything that’s partly valued on the outlook for growth is going to go down. You have a growth scare,” says Russ Koesterich, global chief investment strategist at BlackRock.

Lightning-fast financial markets don’t reward subtle thinking. Traders prefer to simplify the world to a stark daily decision: risk on or risk off. If it’s a risk-on day, people scoop up high-yield debt, stocks in emerging markets, and industrial commodities, including oil—any asset that’s volatile but does well in periods of growth. On risk-off days, they retreat to ultrasafe but low-yielding investments such as U.S. Treasury securities.

There have been a lot of risk-off days lately. That explains why the 10-year Treasury note’s yield, which declines when its price rises, fell below 1.7 percent on Feb. 10, from almost 2.5 percent last June. It also helps explain why both oil (risky) and the S&P 500 (kind of risky) have been heavily sold off. “If you have a multiasset portfolio and you’re looking to de-risk, and you have problems in one sector, you’ll attempt to sell others to get your overall risk profile lower,” says Krishna Memani, chief investment officer at Oppenheimer Funds in New York.

Synchronized plunges this extreme in stocks and oil usually indicate that investors are expecting a U.S. recession, which would kill corporate profits and demand for crude. But how likely is a recession over the next year or so? Not impossible, but not probable.

The most important indicator of economic health is employment. The U.S. created 151,000 jobs in January, less than in previous months but more than enough to absorb the normal flow of entrants into the labor force. The unemployment rate dropped to 4.9 percent, which the Federal Reserve considers full employment. Average hourly earnings rose 2.5 percent from the year before. That’s a real pay raise for American workers, since it’s above the inflation rate, yet it’s not so high as to get the Fed worried about an incipient wage-price inflationary spiral. Meanwhile, companies show no sign of retrenching on employment: In December listed job openings were the highest as a share of all jobs, filled and unfilled, since record keeping began in 2000, according to data released by the Bureau of Labor Statistics on Feb. 9.

Cheap oil, supposedly an economic threat, has done one good thing for the U.S. economy and stocks. It’s kept the overall increase in consumer prices through December to just 0.7 percent. That could help persuade the Fed to throttle back its plans to raise rates. On Feb. 10, Fed Chair Janet Yellen suggested that further rate hikes would depend on whether the market turmoil persists. “Monetary policy is by no means on a preset course,” she told Congress. Low rates are good for both the economy and Wall Street, because stocks become a more enticing alternative when rates are low.

The bears are right that cheap oil is damaging high-cost producers around the world, and some of those are in the U.S. Amazingly, though, some shale producers in America can make money even with prices as low as they are. According to an analysis by Bloomberg Intelligence, producers in the Eagle Ford basin in DeWitt County, Texas, could break even with West Texas Intermediate as cheap as $22.52 a barrel. The countries really being slammed by cheap oil are not the U.S. but the likes of Russia and Venezuela, which have a fatal combination of heavy dependence on oil exports and high production costs. U.S. dependence on those countries as export markets is trivial, as are American bank loans to them. American banks are more exposed to U.S. shale producers, of course. But BCA Research predicts that only 5 percent to 10 percent of bank loans to that sector will go into default this year—and most of those will eventually get repaid as the companies emerge from restructuring.

Yes, declines in corporate earnings tend to presage recessions, and S&P 500 operating earnings have been falling in recent quarters from year-ago levels. But take out energy stocks and they’ve still been rising. Historically, stocks and the economy brush off weak oil earnings: Bruce Kasman, chief economist at JPMorgan Chase, notes that the only years in the recent past when S&P 500 profits fell while the economy held up were 1986 and 1998—which were years when oil prices tumbled, as they’re doing now. Goldman Sachs economists recently put the chance of a U.S. recession at 18 percent within one year and 23 percent within two.

The sense that falling oil is bad for stocks is mostly a matter of timing and conspicuousness. The bad parts of the oil plunge are hitting now: the credit downgrades, the defaults, the investment cutbacks, the layoffs of roughnecks. They’re making news and rattling people’s confidence. “We’ve taken the big hit upfront,” says Chris Varvares, co-founder of St. Louis-based Macroeconomic Advisers. Eventually, the money freed up by cheap oil will leak into other parts of the economy. When oil prices crashed in 1986 and gasoline suddenly got cheap, it didn’t show up in the consumption numbers for more than a year, says David Rosenberg, chief economist at Gluskin Sheff.

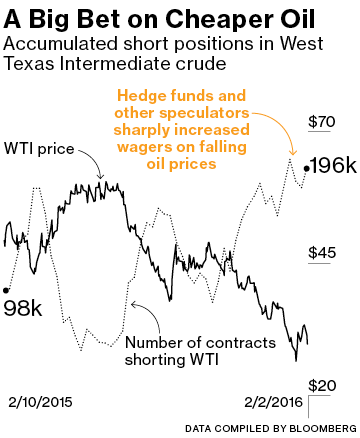

In any case, oil prices this low aren’t likely to last long. The market for crude is driven increasingly by high-frequency, computer-based momentum trading. In July, the CME Group—formerly the Chicago Mercantile Exchange—ended the 167-year history of actual humans trading commodity futures in open pits in Chicago and New York. Computer trading has proved more efficient, but not always better. “There was a governing quality of human input that’s been lost in the market, that sort of prevented this kind of lunacy,” says Dan Dicker, a former oil trader on the Nymex and president of MercBloc, a wealth-management firm. “People could only move but so fast.”

At the moment, says Kopits of Princeton Energy Advisors, “there’s a weird disconnect between any kind of long-term fundamentals and current market values.” Fundamentals tend to win out in the long run. Supply will be curbed as drillers drop projects that are unprofitable at $30 a barrel. And demand will accelerate; people are already driving more miles, albeit in more fuel-efficient vehicles. (A 2015 Ford F-150 pickup gets 30 percent better gas mileage on the highway than the 2005 model.) Oil traders spent most of 2015 increasing their bets that oil prices would fall. Since mid-January they have slightly pared their short positions and bought more contracts that gain value when oil rises.

Barry White began Can’t Get Enough of Your Love, Babe by saying, “I’ve heard people say that too much of anything is not good for you, baby.” Cheap oil is kind of like that for the stock market. But with any luck, their dysfunctional dynamic won’t last much longer.

—With Dani Burger and Oliver Renick

http://www.bloomberg.com/news/articles/2016-02-11/oil-is-the-cheap-date-from-hell